“Play stupid games. Win stupid prizes.” Trade surveillance is not child’s play as demonstrated in the recent conviction of two Deutsche Bank commodity traders who were indicted, convicted and now sentenced to a year and a day in prison. The felonious conduct? Spoofing.

What is spoofing? Explain it to me like I am new to it all.

There are two sides to nearly every market: A Bid and an Offer. Bids are firm offers to buy. Offers are firm offers to sell. A spoof is simply a “fake” order. How do you even do that?

How Bids and Offers Work and Why It Matters When Trading

Imagine you want to sell your car. Someone bids $20K to buy it. You offer to sell it for $25K What happens? Nothing. Not until these two meet. To make a long story short, an exchange simply stands in between traders looking to buy and sell. These traders post their firm intentions by posting bids and offers.

For example, I will sell 100 apple shares at $146 per share (the offer). On the other side someone else is saying they will buy Apple shares for $145 per share (the bid). When someone really wants to buy Apple right now they lift the ask price. In other words they change their bid price to equal that of the offer. Voila a trade is done.

Great. So what exactly did these guys do to get jail time?

So What’s a Spoof in Trade Surveillance Terms?

A spoof is when a trader puts in a “fake” order. It’s fake because the trader’s intent is to play with the minds of market participants rather than intending to be executed.

Spoofing With Apple

Back to Apple. Assume you trade Apple every day. You usually see bids and offers in the 100 to 400 share range. Occasionally you might see an order for 1,000 or 2,000 shares. But this is a bit more rare. Then one day someone posts an offer to sell for 10,000 shares. Huh. Interesting. Looks like someone is trying to get out of Apple. Then that offer to sell turns from 10,000 shares to 50,000 shares.

Whoa!

Only someone huge has that kind of size, and they are getting out quick. Who is getting out? What do they know? Is there news coming? Market is now spooked. Others see this and start selling. The price starts to really drop. Amidst the selling frenzy someone buys 500 shares at a really great price. Suddenly, the 50,000 share order is cancelled and disappears forever.

The 50,000 share order looks like a spoof. It was put there to send false information to the market that selling pressure is high and increasing.

Traders can get clever about how they do this. Instead of 100,000 shares what if they layered in 10,000 sell orders at a one penny difference, but still adding up to 100K shares. That is generally called layering. The permutations here are somewhat endless. For example, what if a trader just “flashed” an order for 100k and quickly cancelled. It’s all the same concept. The order was posted to mislead market participants.

Got it? Well we are not done yet.

When spoofing is not spoofing and why trade surveillance is critical for identifying compliant trades even if they are bad trades

Spoofing is a specific intent crime – what that means is that for jail time, a prosecutor has to show that the trader intended to send false information. In the scenario above. What if the trader REALLY DID have 50,000 Apple shares to sell? What if that trader put out the 50K order but then made the small buy because she was trying to slow down a fast declining market? What if when she realized she put out too many shares and spooked the market she just cancelled the whole thing? A prosecutor has to prove, beyond a reasonable doubt, that the trader intended to mislead the market. In the scenario above, did she have the intent to deceive? No. She is just a bad trader (which to some is an entirely different kind of crime).

If you want to stay out of jail, and are not bad intentioned, trade surveillance systems and compliance officers are your friend not your enemy.

You were placing an order and spilled your coffee. 20,000 lots went in and were cancelled right away. It’s all on the tape. These days every regulator around the globe and (hopefully) your compliance officer has this activity. You might get a visit. Listen. Everyone is sensitive around cancellations. If you don’t know that by now you have not been paying attention. Your intent here is very important. Having a quick internal conversation with your compliance officer and counsel is not a bad thing at all. It might just keep you out of jail. (Pro Tip: Never record investigation conclusions in a surveillance system. See our next blog post on this topic!)

Oh, but it’s so much worse than that - the CFTC whistleblower bounty

The CFTC has placed a bounty on the heads of those who seek to deceive markets. Anyone providing direct evidence that leads to a monetary penalty is eligible to receive up to 30% of the fines above $1 million. The key is proving original information

- Do you need to be an employee whistleblower? No it can be anyone.

- Can it come from a competitor? Yes, it can be anyone.

- Is it anonymous? Yes, it’s anonymous.

- Is there protection against retaliation? Yes.

- Do I have to report internally first? No.

This program has been wildly successful. The CFTC has paid out over $130 million dollars to whistleblowers. And don’t forget, the long arm of the CFTC now reaches entirely around the globe. The CFTC has successfully prosecuted in many different countries for trades made on US exchanges. And here is what you need to know: The CFTC has placed a bounty for submitting evidence of fraud including spoofing. Here are just a few examples we’ve tracked over the past year…Scotia Bank’s $125M fine, Australian trader taken down, and well…there’ll be another one tomorrow.

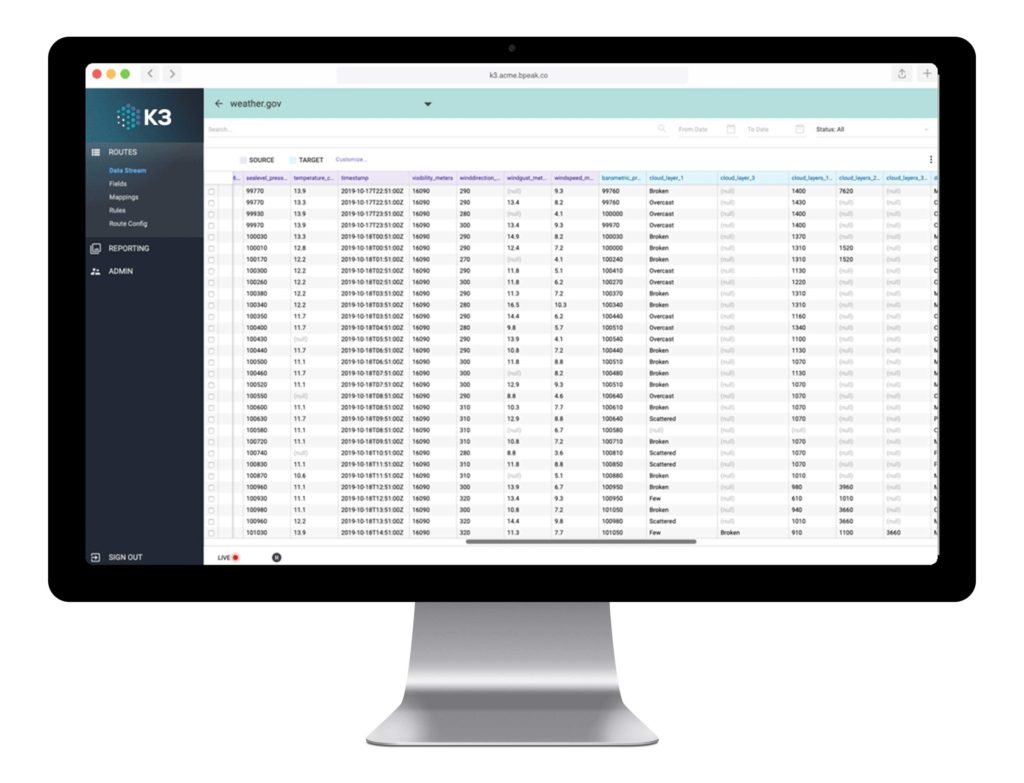

Don’t Get Spoofed When You Can Get K3

Our software system, K3 Surveillance, is designed to detect spoofing. It connects in real time to every button pressed by traders on their trading screens. And K3 can deploy virtually anywhere. Whether it’s on premise, on the cloud K3 can get you running quickly. As always if you have surveillance questions do not hesitate to drop us a line or just get in touch with our team below.