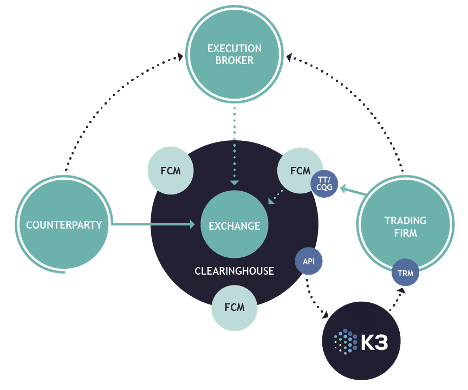

General Data Flow for Futures Exchanges

If you aren’t already familiar with the general plumbing for exchange futures trading, be sure to read the top section of this previous post before you get started.

Glossary for Nodal Trades

Over the Counter (OTC) – Direct trading between two parties. Could be executed via a broker.

Clearinghouse – Risk shock absorber for the market in case participants have financial stress

Counterparty – Each participant in a trade is known as a party on the trade. Counterparty usually means the other party in a trade.

Hedge – Protection against financial loss. In this context, simply swapping a floating price for a fixed price to manage price uncertainty.

Basis Risk – Risk due to difference in price between the thing being hedged and the thing used to hedge

Block Trades – Privately negotiated futures/options transactions greater than a minimum volume threshold such that they can be executed outside the exchange. Highly regulated and scrutinized type of trade.

History of Nodal Exchange

Futures exchanges exist so companies can manage risk. The fluctuating prices which companies will be exposed to in the future can be hedged today.

Nodal is a futures exchange specializing in power, natural gas, and environmental credits. The story of Nodal’s growth gives insights into the various components of a futures exchange and clearinghouse

Before Nodal

The North American power grid has different prices at different locations (a.k.a. Locational Marginal Pricing). More populated locations gain the most interest from the market and thus have “high liquidity”. High liquidity generally makes hedging prices easier. A utility company in a small town, on the other hand, is exposed to prices which have low liquidity, or less buyers and sellers.

In cases of low liquidity, hedging can involve using brokers to try and find a counterparty to trade with. Or it can involve an imperfect hedge via futures contracts at the nearest liquid location (“hub”) and just accepting the locational price difference. In other words, there would be some difference between the price the company is exposed to and the final settlement price for the futures contract. That price difference is called “basis risk”.

If that basis risk manifests in an unexpectedly high price for the utility, the result is high prices for consumers.

Act One: The Nodal Exchange

Enter Nodal Exchange. They’ve gathered the existing brokered activity at lower volume power hubs into an official exchange, bringing liquidity and price discovery to a previously decentralized market.

We may think of a futures market as electronic screens and ticking prices, but brokered block trades exist in other US exchanges as well. Also, Nodal added the risk buffer of a third-party clearinghouse in between the two counterparties.

We now have happier utilities who can hedge risk more easily.

Act Two: Nodal Clear

Nodal took a bold step after aggregating liquidity at previously illiquid locations. They moved from using LCH as a third-party clearinghouse to building their own. Rather than stick with the usual risk models, Nodal developed a proprietary portfolio risk model that was tailored for energy markets and scalable for other contract groups.

Net Result – Some firms have optimized margin requirements by moving to Nodal. This isn’t universally true, but by doing things differently, Nodal has given the market options.

Act Three: Screens and Clicks

After 12 years now, over half the open interest in US power futures is held on Nodal contracts. While early activity focused on addressing basis risk, Nodal is now a large percentage of the outright trading. In 2019 they acquired all the futures business from Nasdaq, who had previously launched a US futures exchange focused on natural gas, power, and oil.

With liquidity, price discovery, and clearing all solved, what did Nodal do next? They established screen trading via a number of third-party platforms. At this point, both brokered executions and direct screen executions were possible.

Sidebar on exchanges: Once a venue has screens, compliance teams need order data which provides details on every click into the market, and let’s firms ensure their traders aren’t doing anything which could be flagged by authorities as non-compliant with the rules.

A refresher on the data flows:

One Stop Shop—Data as Legos

Nodal began with a broker executed market, but they thought about data flows and ownership up front. When a broker inputs a trade into their exchange platforms, the counterparties on the trade have to be declared up front. This way, data is automatically routed to end firms via Nodal’s FIX Trade Capture API.

This differs from some other markets where a trade can be executed in the broker’s name and then given up to the end firm after execution. The lack of extra hops means trade data from Nodal is instant and clean.

When Nodal added screen trading, the existing straight-through processing architecture just kept ticking. They simply ship more legos of the same shape through the same pipes. So if your firm is already connected to Nodal’s Trade Capture API for broker-executed trades, you need to do nothing to start receiving and flowing screen trades downstream.

So the data is straightforward. How about the data plumbing to our systems?

Nodal’s Trade Capture API operates on the FIX protocol leveraging FIX 5.0 for data.

Nodal’s TC API sends everything at the lowest level of granularity. This means that, as traders execute complex structured trades consisting of multiple futures/options, each future/option trade flows as an individual payload united by a common ID.

It’s hard to stack custom lego shapes. The consistency around Nodal data makes downstream data management easy.

There are fields to indicate if the trade was a block trade rather than executed on screen. Furthermore, they are adding an “OrderID” at the end of April 2021 so teams can tie data flows back to the order submitted into the exchange.

Nodal’s TC API does offer unique functionality for history requests. Typically, you would ask for trades since a particular point in time. With Nodal, you can request activity for any particular day. The flip side here is that if you wanted all your trades for the past week, you would have to make 7 requests.

Finally, you must make separate connections for each FCM through which your firm clears Nodal trades. This has to do with the setup for streamlining brokered block trades directly into customer accounts, which was the original model for Nodal trades.

Common Issues

- How are trade amendments represented?

- Given Nodal’s start in the block trade world, all amendments are represented as a cancel and a replace. First a cancelation of the original trade will flow, followed by a new trade to replace the original.

- Our API connection gets timed out while making multiple history requests for missed days

- Simply backing off the time between requests will solve the issue here.

- Can we get a parallel feed of our trading activity

- You can set up more than one production API ID as needed.

- We clear Nodal via multiple FCMs. Does that complicate our trade feed setup?

- You simply need to make a separate connection for each FCM. Nodal would set you up with 1 API ID per FCM.

- How about security to the API?

- Nodal’s team will need to whitelist the IPs from which you will connect to their API.

Here to Help

Want to keep the learning going or get answers in real-time? We’re here for you. Take advantage of our complimentary office hours—yes, really—or subscribe to our blog below and receive all upcoming posts.

Need to catch up with our earlier posts in this series? Check out former hot topics including: Where Are My ICE Trades?, ICE Trade Capture Unpacked, and Real-Time Trade Data from the CME.

Office Hours with Vivek

Office Hours with Vivek

Sign up now for a complimentary meeting with our Exchange trade expert for real-time TRM help.

Trade Data Supply Chain Demystified: The Latest Updates

Understanding The Data Supply Chain, From Start to Finish.

Trade Data Supply Chain Demystified Part 1: Where Are My ICE Trades?

New Definitive Guide & Checklist for ICE Trades | Part One of Five This is the first in a series of five blogs examining the

Trade Data Supply Chain Demystified Part 2: ICE Trade Capture Unpacked

Tracking Trade Data from an Order to Instant Risk/PnL | Part Two of Five In this second post in our series of blogs discussing the

Trade Data Supply Chain Demystified Part 3: Real-Time Trade Data from the CME

General Data Flow for Futures Exchanges This is Part Three of our five-part series on demystifying the trade data supply chain. Be sure to read