New Definitive Guide & Checklist for ICE Trades | Part One of Five

This is the first in a series of five blogs examining the futures and options trading environment. The series will discuss how to streamline trade data management to enable automation, scalability, and regulatory compliance no matter the size of your firm. Once you’ve read to the bottom, join us for part two, where we discuss tracking trade execution and data workflows.

In a world where we can video chat with friends around the world with the click of a button, it makes no sense that people are still manually entering trades.

But it is a common scenario: A trader executes a trade on ICE, but no trade message flows from the exchange. Here is a helpful checklist of what could be going wrong in the Trade Data Supply Chain.

If you are already familiar with ICE trade data flows, enjoy the raw checklist of tasks to make it work.

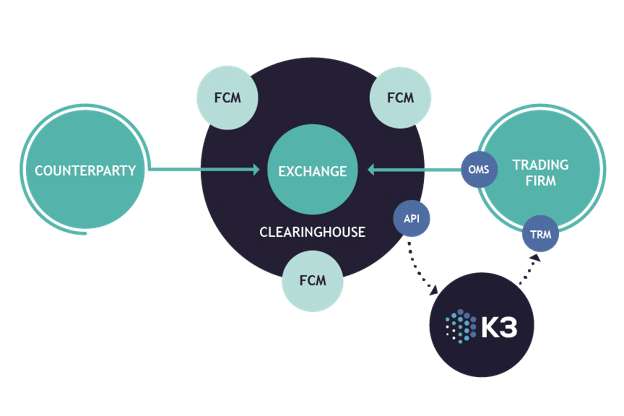

If you are new to the world of futures trading, start by examining the Data Supply Chain image and the “Trades and Terminology Resources” below. Then stay tuned for the next post where we will unpack the futures data supply chain end to end.

Data Supply Chain

A critical concept in enterprise futures trading is that there is a supply chain at the heart of how trade data flows from the time a trader clicks Buy/Sell to the time a trade message shows up in an internal risk system.

Must-Have Terminology and Resources for ICE Trades

If you are unfamiliar with the industry jargon, these links should help you digest the flow above:

Order Management System (OMS) – Software that “screens” traders’ use to interact with the Exchange

Futures Exchange – Marketplace for trading futures and options

Clearinghouse – Risk shock absorber for the market in case participants have financial stress

Clearing Broker (a.k.a. Futures Clearing Merchant or FCM) – An entity that collects margin from participants on behalf of Clearinghouse

ICE Trade Capture API (TC API) – Technical interface through which participants can receive a feed of their trading activity

Trading Risk Management system (ETRM, CTRM, TRM) – Enterprise software used by various trading firm groups to manage a trade from start to finish

Subscribe and receive relevant insights for solving everyday data challenges.

Find Every ICE Trade With This “Trade Type Specific” Checklist

For Regular Listed Trades

These are listed futures and options traded electronically using WebICE.

- FCM-hosted OMSs must establish FIX sessions in the client firm’s name directly

- API IDs must have permissions to flow trades from each market

- API IDs must have permissions to flow security definitions

- Clearing accounts set up to flow trades to the ICE TC API (especially important when setting up new clearing accounts)

If you have these set up correctly and are still losing trades, then it is likely an issue with the software connecting to the TC API

For Broker-Executed Trades

These are executed off-screen using a broker.

- In addition to the checklist for vanilla listed trades…

- FCMs must enable allocations for each combination of broker, legal entity, and clearing account

- Software connecting to TC API has to request allocations data to flow

- Allocations data has to be normalized to look like a regular trade

- For User-Defined Strategies (UDS)

These are strategy trades which are generally made up of multiple underlying futures or options trades.

- This is all about technology. UDS security definition messages will flow in real-time while connected to the TC API and have to be used to enrich UDS trades.

For Block Trades

These are broker executed trades greater than a minimum volume threshold.

- FCMs must enable block trades to flow for each combination of specific broker, legal entity, and clearing account

These are just the common challenges you must overcome to make sure trade data can flow on the ICE TC API. Many firms still have particular challenges due to different trading patterns, legal structures, or technology footprints.

Next up in our five-part series on demystifying the data supply chain, we’ll cover how ICE data flows from a user’s screen to the trader’s clearing house. Read on to learn more.

Here to Help

Want to keep the learning going or get answers in real-time? We’re here for you. Take advantage of our complimentary office hours – yes, really – or subscribe to our blog below and receive all upcoming posts.

Office Hours with Vivek

Sign up now for a complimentary meeting with our ICE trade expert for real-time TRM help.

Vivek Pathak in

Chief Operating Officer

Vivek is the Chief Operations Officer and Founder of BroadPeak Partners. He is the titanium backbone behind BroadPeak’s efficient operations and absolute champion of efficient operations & development. Prior to BroadPeak, Vivek was COO at Barclays and Lehman Brothers where he drove efficiency and PMO for highly complex fixed income, FX and commodity software projects. Mr. Pathak began his career in a Big 5 Consulting firm as a Project Manager and worked with large companies such as AGL, Duke Energy and UBS. He trained as a Chemical Engineer and graduated with a B.Sc from the University of Alberta. Vivek lives in New York City with his wife and 2 children.