The way it should be

Regulatory Reporting

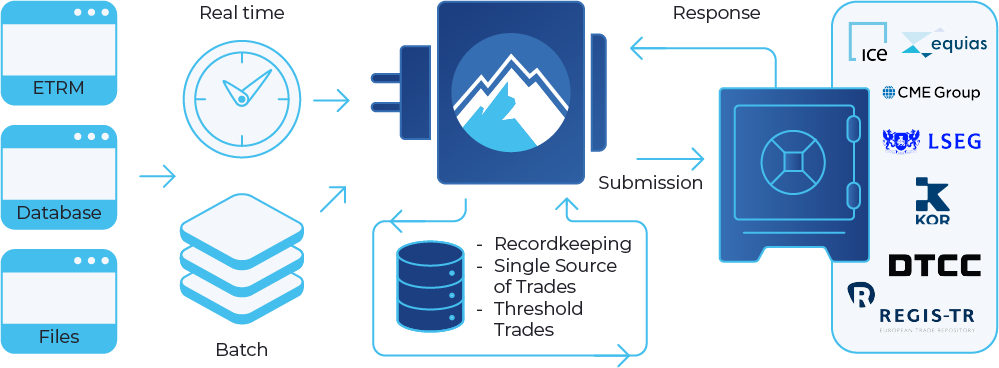

Regulatory reporting is often manual, fragmented, and time-consuming. Global rules like Dodd-Frank, EMIR, and REMIT require timely, accurate trade submissions. BroadPeak’s Regulatory Reporting solution, built for energy and commodity trading firms, simplifies this with pre-built adapters for trade repositories including ICE Trade Vault, DTCC, CME SDR, Equias, and LSEG Post-Trade. Unlike other solutions our approach is fully automated.

Reporting made easy

Streamlined and automated

Avoid the manual effort of traditional reporting with BroadPeak’s Regulatory Reporting solution. Out-of-the-box connectivity to major trade repositories and automated workflows reduce operational burden and keep energy and commodity trading firms ahead of compliance.

When rules change, BroadPeak clients adapt in hours, not months. No vendor delays or resource-heavy rewrites, just immediate control over your data and reporting logic.

Repository connectivity

We map and route trades directly from your system of record to the swap data repository. Trades are transformed into the required format and submitted to the appropriate trade repository, seamlessly, reducing friction and saving time.

Live confirmations

With BroadPeak's Regulatory Reporting solution, energy and commodity trading firms get real-time confirmations and instant alerts on submission errors to avoid penalties, and keep your reporting on track.

End-to-end transparency

BroadPeak's Regulatory Reporting solution maintains a complete, time-stamped record of all your regulatory reporting activity. Every trade and data payload is fully traceable, giving you total visibility into what was sent, when, and how, across all trade repositories.

Cross jurisdictional

Ensure compliance across global regimes, including Dodd-Frank, MiFID II, REMIT, Canada, MAS, and ASIC, with a solution purpose-built for cross-jurisdictional reporting.

Self service

Adapt swiftly to new products, trade types, or markets without waiting on IT. Our intuitive web interface lets energy and commodity trading firms update reporting seamlessly to meet evolving repository standards.

Error free

Energy and commodity trading firms cannot afford to leave their data movement to chance. BroadPeak is built from the ground up to ensure every data payload moves smoothly and reaches its destination accurately and securely.

Out-of-the-box connectivity

Faster reporting

BroadPeak’s prebuilt adapters provide energy and commodity trading firms with out-of-the-box connectivity to global repositories.

Our network

10+ years of close collaboration with global repositories

Perspectives

Insights

- Blog

Tackling compliance, data integration, and IT overload in global operations

- Case studies

Fortune 500 agricultural firm meets regulatory deadlines with ease

- News

Mercuria selects BroadPeak middleware for global compliance and integration