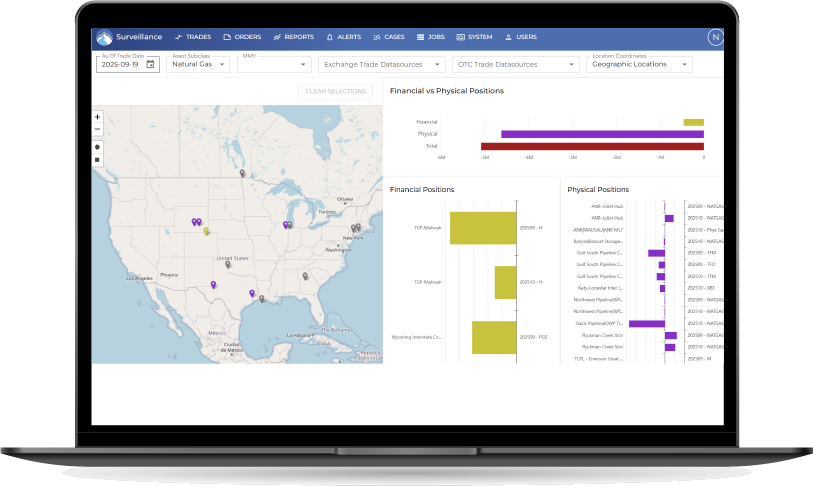

See the whole picture

Physical and financial trade surveillance

Energy and commodity trading firms need faster, more accurate ways to detect market abuse across both physical and financial trades. BroadPeak’s Trade Surveillance solution integrates OTC, E/CTRM, and exchange data so you can monitor all trading activity in one place. With direct, certified connectivity to exchanges including ICE, CME, Nodal, ElectronX, and leading execution platforms, we centralize and standardize data to streamline alerts and accelerate investigations.

See more, act faster

Focus on what matters

With BroadPeak’s Trade Surveillance solution, energy and commodity trading firms get clear, prioritized trading insights so you can focus on the highest risks.

Real-time monitoring

A centralized view of critical insights allows energy and commodity trading firms to quickly access high-priority alerts, track open cases, and analyze trading/order activity efficiently.

Deep market visibility

Intuitive visualizations, customization, and drill-down tools deliver clear insight into trader behaviors. Identify spoofing, layering, washing, Phys/Fin, and block trades.

Intelligent alerting

Our machine learning model prioritizes high-risk behavior, reducing false positives by learning from your historical alert resolutions. Focus on the most critical compliance issues while the system handles routine pattern detection.

Order book depth

Accelerate investigations with deep order book data. Up to 10 levels of depth for ICE and CME lets analysts trace suspicious market activity with greater precision and context.

Physical trade visibility others miss

Complete oversight of E/CTRM activity

BroadPeak’s Trade Surveillance solution integrates directly with your E/CTRM systems, capturing physical trade data that traditional surveillance tools ignore. This enables cross-market surveillance that connects physical positions with financial hedging activity.

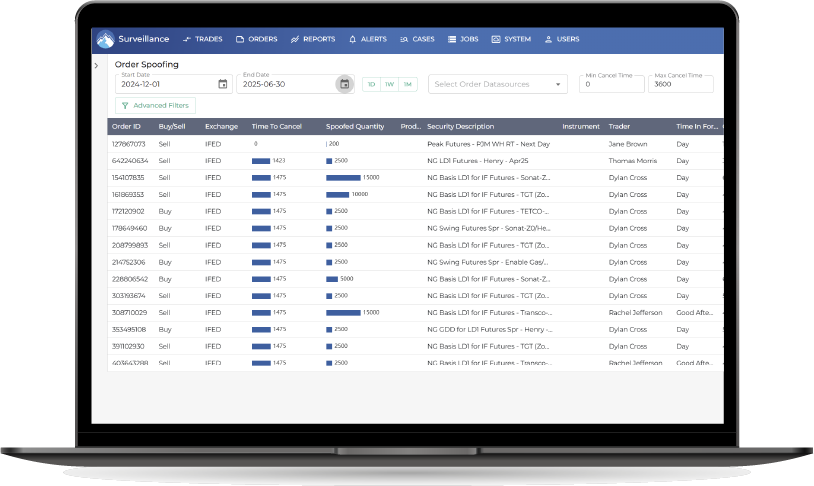

Trade surveillance and spoofing in commodity markets

Commodity markets depend heavily on transparent price discovery, making spoofing particularly disruptive to market integrity.

Smarter trade surveillance

Insight that counts

BroadPeak Trade Surveillance captures all orders and trades in a single, centralized platform. By combining OTC, exchange, and internal trading data, energy and commodity trading firms gain a complete view of market activity, making it easier to detect spoofing, wash trades, and other forms of market abuse.

Cross-market surveillance reduces false positives

BroadPeak’s Trade Surveillance solution captures all orders and trades across exchanges, OTC, and physical markets in one platform. Monitor spoofing, wash trading, and layering with complete market context. See correlated activity across ICE, CME, Nodal, and E/CTRM systems to distinguish legitimate trading from market manipulation.

Custom alerts for business-specific compliance

Create custom surveillance alerts to monitor key business activities: trades with specific brokers, transactions above size thresholds, activity in restricted products, or unusual trading patterns. Automated workflows route alerts to the right analysts based on market, product, or manipulation type. Pre-configured rules detect front running, momentum ignition, and benchmark manipulation without manual monitoring.

Configure surveillance rules without IT support

Our intuitive interface lets compliance teams update firm IDs, onboard new asset classes, adjust alert thresholds, and adapt to regulatory changes independently. No coding or development cycles required. Modify surveillance parameters for REMIT, MAR, FERC, and CFTC compliance as regulations evolve. Your compliance team stays in control, cutting response time from weeks to hours.

Audit-ready compliance documentation and reporting

Case management captures every surveillance investigation with complete audit trails. Capture alert details, analyst notes, trader communications, supporting evidence, and final disposition. Pre-built reports for REMIT, MAR, CFTC, and MiFID II examinations show alert volumes, investigation timelines, and resolution outcomes. Regulators see evidence-based compliance in minutes, not days.

Real-time data aggregation from multiple trading venues

BroadPeak’s Trade Surveillance solution aggregates data from ICE, CME, Nodal, and other exchanges, as well as physical trades from E/CTRM systems and OTC bilateral transactions. This eliminates the need to switch between exchange portals, trading systems, or execution platforms. Investigators access complete market context in one platform.

Accelerate onboarding with machine learning insights

Machine learning flags high-priority alerts based on historical investigation outcomes. New analysts learn faster by reviewing past cases with full context: market conditions, trader behavior patterns, and experienced analyst notes. Pre-classified alert patterns help junior staff understand both technical surveillance and human judgment required for complex investigations.

Enterprise-wide surveillance

Operations, Risk, and Front Office teams use the same surveillance solution to monitor trading activity, positions, and market exposure. Compliance data informs risk limits, trader performance evaluation, and strategic business decisions. What starts as regulatory requirement becomes competitive advantage. Real-time alerts protect against reputational damage, regulatory fines, and trading losses from market manipulation.

How BroadPeak Trade Surveillance works

Four-step surveillance process

Data integration

Ingest trade, order, and quote data from exchanges including ICE, CME, and Nodal, alongside execution platforms, OTC trades, and E/CTRM systems. Real-time streaming via FIX protocol, REST APIs, and certified exchange feeds ensures no data gaps and creates a single, standardized surveillance dataset across both physical and financial markets.

Alert generation

Over 120 configurable alert rules detect a broad spectrum of market abuse behaviors including: spoofing, layering, wash trades, cross-market manipulation, momentum ignition, quote stuffing, front running, banging the close, benchmark manipulation, and physical/financial patterns. Machine learning prioritizes alerts based on historical resolution patterns, helping teams focus on the highest-risk behaviour without alert overload.

Investigation workflow

Analysts access complete market context, including order book depth, trade sequences, , and position data. Drill-down visualizations reveal trader behaviour patterns across products, venues, and time periods, enabling faster and more accurate investigations.

Audit trail and reporting

Case management captures every investigation step, including evidence, notes, attachments, and outcomes. Generate audit-ready reports for REMIT, MAR, FERC, CFTC, and MiFID II reviews. All system actions are logged to support regulatory examinations and internal oversight.

Every order counts

Total transparency

BroadPeak’s Trade Surveillance solution allows energy and commodity trading firms to capture every bid, cancel, amend, and quote acknowledgment in real time. With this level of visibility, firms can cut through the noise to detect manipulative behaviors like spoofing, layering, and wash trades.

Frequently asked questions

Expert answers to common questions from energy and commodity trading firms on BroadPeak’s Trade Surveillance solution.

What's the difference between BroadPeak and enterprise surveillance platforms?

BroadPeak focuses on energy and commodity markets with alerts for physical/financial correlation, convergence bidding, and basis trading. We integrate with E/CTRM systems that enterprise platforms miss. Implementation takes weeks, not months.

What types of market abuse can BroadPeak detect?

Spoofing, layering, wash trades, cross-market manipulation, front running, banging the close, momentum ignition, and Phys/Fin patterns. We capture every order placement, modification, and cancellation in real time with order book depth up to 10 levels for ICE and CME.

Does BroadPeak support both physical and financial trades?

Yes. BroadPeak integrates OTC trades, bilateral swaps, and off-exchange transactions alongside exchange data from ICE, CME, and Nodal. Every order—”every button click on the exchange”—is captured. Physical and financial positions are analyzed together to detect Phys/Fin manipulation patterns unique to energy markets

Can I see all potential violations without alert overload?

Yes. BroadPeak decouples alerts from surveillance events. View all potential wash trades in reports while alerts trigger only on narrow criteria. For example, see wash trades across the full trading day but receive alerts only for transactions within 60 seconds at 5% price sensitivity. You control what generates alerts versus what stays in reports.

Can the system automate regulatory reporting?

Yes. Case management captures alert details, analyst notes, evidence, and trader communications with complete audit trails. Generate reports for REMIT, MAR, FERC, CFTC, and MiFID II examinations showing alert volumes, investigation outcomes, and response times.

How customizable are the surveillance rules?

Fully configurable without coding. Wash trade detection follows regulatory rules (offsetting transactions, same contract, same day, similar price) but you adjust parameters: narrow the time window from full day to 60 seconds, set price sensitivity from 5% to exact match. Spoofing thresholds separate algo trading (zero seconds) from trader behavior (1+ seconds). BroadPeak also develops custom reports during implementation.

The company we keep

Clients

Ready for anything

Deploy with confidence

Our secure managed hosting on AWS uses Virtual Private Clouds (VPCs) for robust protection, while easy-to-build data streaming ETL pipelines move data seamlessly to Redshift or Snowflake through a low-code interface.

Perspectives

Insights

- Blog

BroadPeak’s Trade Surveillance solution gaining traction

- Blog

Trade surveillance: Balancing technology with human expertise

- Blog

Trade surveillance is not a box-ticking exercise