- Products

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Quick to deploy AWS data solution with intuitive ETL.

-

-

-

-

Upstream

-

Downstream

-

-

-

-

- Solutions

- About

- Blog

- See K3 In Action

K3's Trading Solutions

FIX CONNECTIVITY TO ICE, CME, DERIVATIVES EXCHANGES, REGULATORY REPOSITORIES AND MORE

Exchange Connectivity

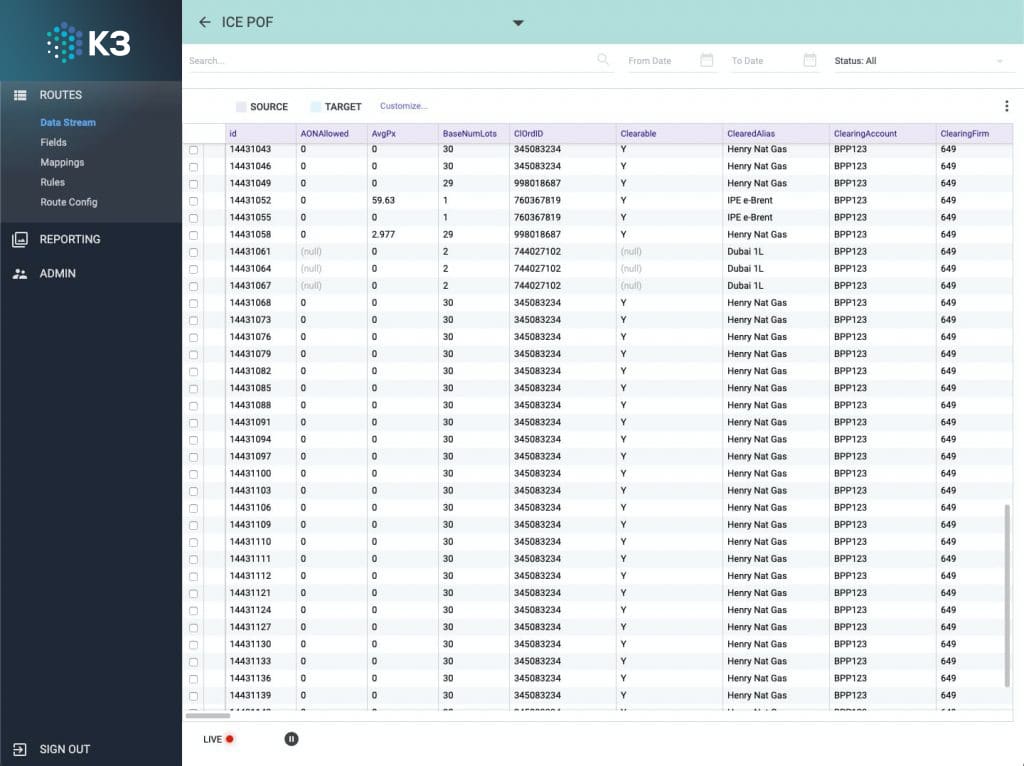

K3 IS THE INDUSTRY STANDARD FOR TRADE DATA

- Real-time exchange trade data delivered to your doorstep

- Off-the-shelf, certified trade connectivity for CME, ICE, Nodal, Exchanges, Brokers, and FCMs

- Adaptors to every trading and risk management system for real-time trades

- Data provenance with alerts to eliminate reconciliations

- Up and running in days not months

Regulatory Reporting

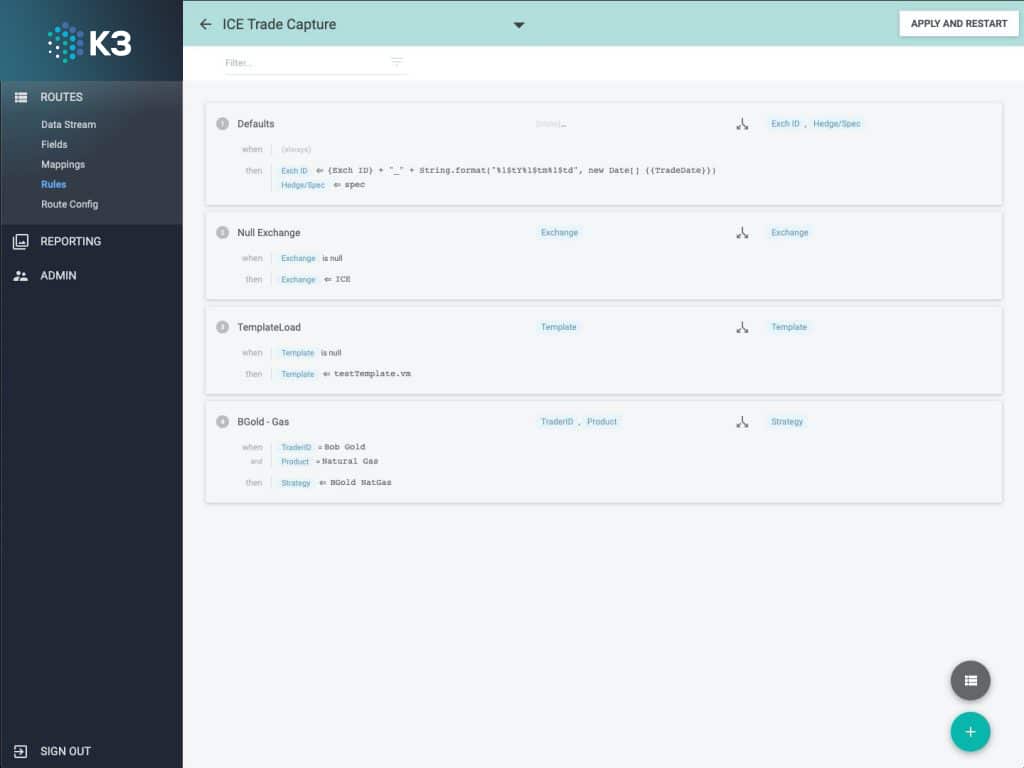

OFF-THE-SHELF REPORTING

- K3 customers submit trades daily for Dodd-Frank, Canada Trade Reporting, REMIT, EMIR, FinFrag, and MIFID II

- Compliance teams can rest easy with workflow automation, fully transparent validation rules and filters, real-time alerts, and submission acknowledgements

- K3 is designed to easily connect to multiple repositories and adapt to reporting differences across regimes

- K3 a tracks the status of every single trade report in an intuitive workflow

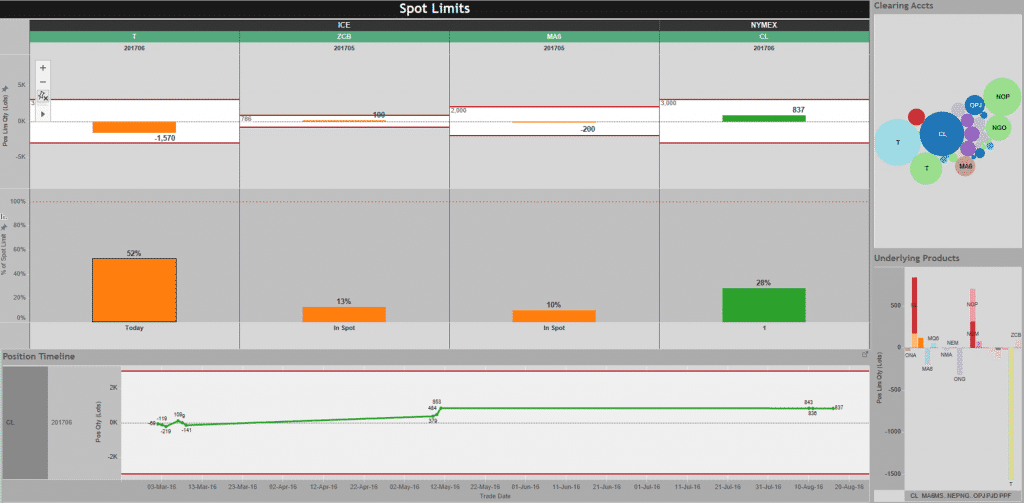

Position Limits

ACTIONABLE INTELLIGENCE AT YOUR FINGERTIPS

- K3 Limits covers both Exchange and MiFID II Limits, and is prepared for Dodd-Frank Limits

- Users access customizable, intelligent visualizations

- Compliance teams instantly access all required info to take action

- Daily updated reference data direct from Exchanges and Regulators

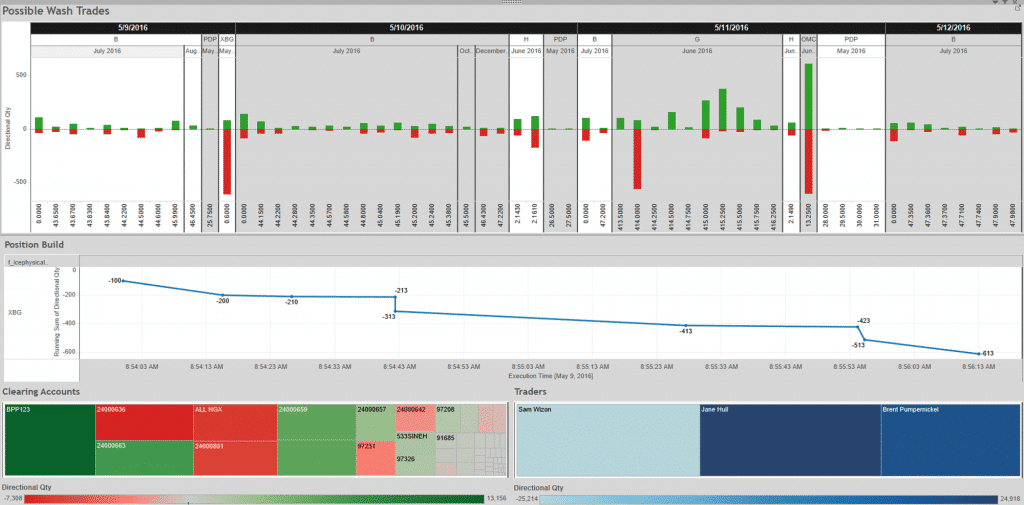

Surveillance

COMPLETE, CLEAN, HARMONIZED DATA

- K3 connects directly to Exchanges, such as CME and ICE to compile the data you need in real-time

- Quickly get your surveillance program off the ground, and make adjustments as the markets and your business evolve

- Some of K3’s connections:

- ICE / CME / Nodal Trade Capture APIs

- ICE Private Order Feed

- CME Drop Copy (for Orders)

- TT Trades & Orders

- CQG Trades & Orders

- FCM data feeds

- Focus your compliance team on events that really matter with visual reports that allow you to see exceptions and refine signals from noise