- Products

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Quick to deploy AWS data solution with intuitive ETL.

-

-

-

-

Upstream

-

Downstream

-

-

-

-

- Solutions

- About

- Blog

- See K3 In Action

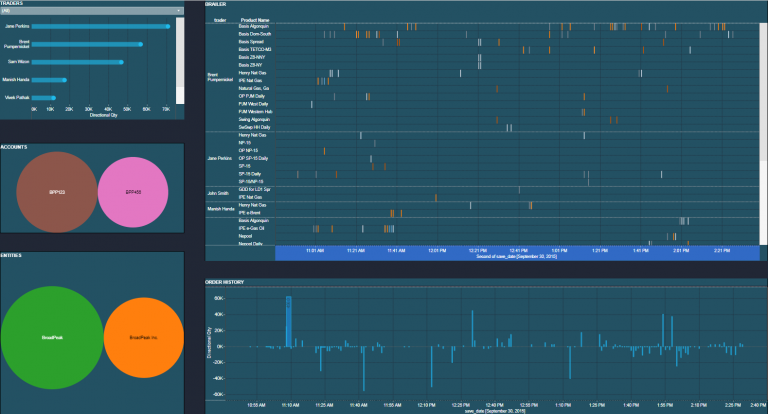

Clean Data Means Better Surveillance

Actionable surveillance is built on clean data.

Experience transparency with control – you set the parameters.

K3 Trade Surveillance Covers You

- Wash Trading

- Slamming the Market (pre and post market)

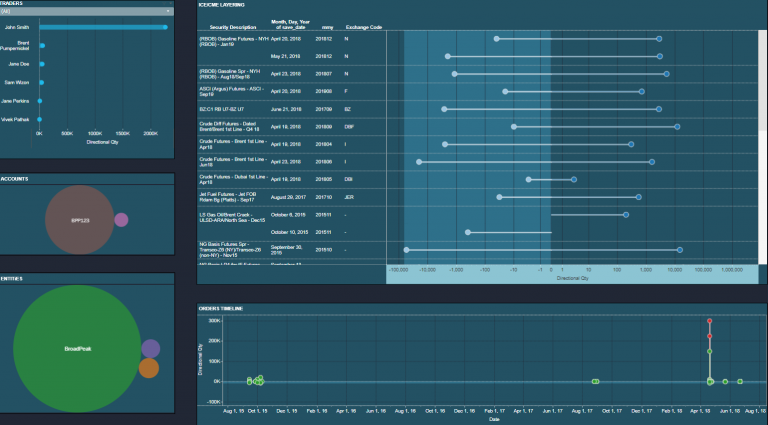

- Spoofing the Market (layering and other)

- Simple Spoofing

- Physical vs. Financial Manipulation

- Off Market Trades

- Large Trade Execution

- …many others

Trade Surveillance Tips

FLEXIBLE REPORTS

Trading businesses are constantly evolving.

Dynamic markets and changing trading patterns deserve flexible, customizable reports. After all, we’re not just checking the box here.

Avoid the infamous hard-baked reporting layer for surveillance technology.

REGULATORY OPTIONALITY

Spoof is likely one of the worst terms ever coined. Why? Simply because it is so vague. At its heart, however, spoofing refers to “disingenuous bidding behavior.”

Similarly, wash trades can be going long and short at a “similar” price.

These are just a couple of ways surveillance technology needs to offer human discretion.

ORDER ACTIVITY

The key to trade surveillance is order activity. However, the wrench in most compliance programs is that some exchanges do not expose order data to their customers.

This is the single greatest obstacle preventing comprehensive surveillance. Not sure if an exchange offers (or plans to offer) order data? K3 can help.